Can Installing a Vehicle Tracker Reduce Your Car Insurance Premiums?

In the UK, the rising cost of car insurance has become a pressing concern for many drivers, including us. With premiums influenced by factors like age, driving history, and the type of vehicle, finding ways to reduce these costs is something many drivers are actively seeking.

One increasingly popular method is installing a vehicle tracker. But does having a tracker really help lower your insurance premiums? Let’s explore this question in detail.

What is a Vehicle Tracker?

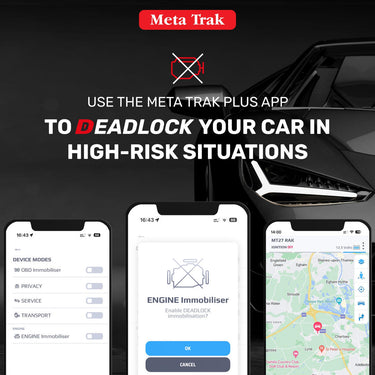

A vehicle tracker is a device installed in your car that uses GPS, along with other technologies, to track its location in real-time. These devices range from basic GPS trackers to advanced systems that also monitor driving behaviour, such as speed, acceleration, and driving patterns.

While originally intended for security purposes—like helping recover stolen vehicles—trackers are now being considered for their potential to reduce insurance premiums. But does installing one actually lower your insurance costs? Let’s dive into the details.

How Do Vehicle Trackers Affect Insurance Premiums?

The idea behind using a vehicle tracker to lower premiums is all about risk management. Insurance companies calculate premiums based on the perceived risk of insuring a vehicle and its driver. By installing a tracker, you could reduce that risk in several ways:

- Theft Prevention and Recovery: Cars with trackers are less likely to be permanently lost if stolen, as the device can help police quickly recover the vehicle. This lowers the risk for the insurance company, which could translate into reduced premiums.

- Improved Driving Behaviour: Some trackers, especially telematics devices, monitor how you drive. If the data shows that you drive safely—obeying speed limits and avoiding risky behaviours—insurers might reward you with lower premiums.

- Mileage Tracking: Trackers can also log how many miles you drive. If your mileage is lower than average, this could lower your premium as you spend less time on the road, reducing the likelihood of accidents.

-

Enhanced Security Features: Modern trackers often include additional security features like geofencing and tamper alerts, further reducing the chance of theft or damage. This added layer of security can positively impact your premiums.

Do All Insurance Companies Offer Discounts for Trackers?

While vehicle trackers can help reduce premiums, not all insurance companies offer discounts. The availability of discounts often depends on the insurer and the specific type of policy you have.

Here’s what you need to know:

- Specialist Insurers: Insurers that cater to high-risk drivers or vehicles, such as young drivers or luxury cars, are more likely to offer discounts for trackers. These insurers understand the added security benefits that trackers provide.

- Telematics Policies: Insurers that offer “black box” or telematics policies are most likely to offer discounts based on your driving behaviour. These policies are particularly popular with younger drivers, who generally face higher premiums.

-

Traditional Insurers: Larger, more traditional insurers may not offer specific discounts unless you have a telematics policy. However, even if a direct discount isn’t available, having a tracker could help you negotiate a lower rate when renewing your policy.

How Much Can You Save?

The potential savings from installing a tracker can vary widely. Some drivers report savings of between 5% to 30% on their premiums, depending on the type of tracker and the insurer.

For younger drivers or those with high-performance vehicles, the savings can be even more significant, given their typically higher baseline premiums. However, it’s essential to weigh these savings against the upfront cost of the tracker, which can range from £150 for basic models to £550 for more advanced systems. Some trackers may also require ongoing subscription fees.

Factors to Consider Before Installing a Tracker

Before deciding to install a vehicle tracker, here are a few things to consider:

- Type of Tracker: If your goal is to reduce insurance premiums, a telematics device that tracks driving behaviour might be more effective. For theft prevention, a basic GPS tracker may suffice.

- Insurance Policy Terms: Check with your insurer to understand how a tracker could impact your premiums. Some insurers require specific types of trackers to qualify for discounts.

- Installation Costs: Factor in the cost of the device, installation, and any ongoing fees. Ensure the potential savings on your premiums justify these expenses.

- Data Privacy: Telematics devices collect detailed data about your driving habits. Consider whether you’re comfortable sharing this information with your insurer.

-

Maintenance: Make sure the tracker is properly maintained and operational. A faulty tracker could lead to higher premiums if your insurer assumes it’s still functional.

The Future of Vehicle Trackers and Insurance

As technology continues to advance, vehicle trackers are likely to play a more significant role in insurance pricing. The shift towards personalised insurance—where premiums are based on individual behaviour rather than broad demographics—will likely increase the adoption of telematics and tracking devices.

In the future, we may see trackers and other telematics devices become standard in new vehicles, making them an integral part of how insurers calculate premiums.

Is a Tracker Worth It?

So, does installing a tracker reduce your insurance premiums? The answer is—it depends. For some drivers, particularly those with high-risk profiles or expensive vehicles, the savings can be substantial. However, the extent of those savings will vary based on the type of tracker, the insurer, and your driving habits.

Before making a decision, it’s essential to do your research. Compare different devices, review your insurance policy, and calculate how much you could realistically save. For safe drivers looking to lower their premiums, a tracker could be a valuable investment.

If you need help choosing a tracker or understanding how it could impact your insurance, our team is here to help. We have a wide range of trackers available, and our experienced team can guide you in selecting the right one for your needs. Feel free to call us on 07519025078, Monday to Friday from 9 am to 6 pm, and we’ll be happy to assist!